UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ | Preliminary Proxy Statement | |||

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| [ | Definitive Proxy Statement | |||

| [ ] | Definitive Additional Materials | |||

| [ ] | Soliciting Material Under Rule 14a-12 | |||

EXCHANGE TRADED CONCEPTS TRUST EXCHANGE TRADED CONCEPTS TRUST II | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

EXCHANGE TRADED CONCEPTS TRUST

Forensic Accounting ETF

ROBO-STOXTM Global Robotics and Automation Index ETF

Janus Equal Risk Weighted Large Cap ETF

(formerly, VelocityShares Equal Risk Weighted Large Cap ETF)

YieldShares High Income ETF

EMQQ The Emerging Markets Internet & Ecommerce ETF

Yorkville High Income MLP ETF

Yorkville High Income Infrastructure MLP ETF

2545 South Kelly Avenue, Suite C, Edmond, Oklahoma 73013

EXCHANGE TRADED CONCEPTS TRUST II

Horizons S&P 500® Covered Call ETF

2545 South Kelly Avenue, Suite C, Edmond, Oklahoma 73013

Please read carefully - time sensitive action is requested.

Dear Shareholder,

I am writing to inform you about an upcoming special meeting of shareholders for each of the exchange traded funds listed above (the “Funds”) for which Exchange Traded Concepts (“ETC”) serves as investment adviser and to request your vote for those items on the ballot for this meeting.

On January 15, 2015, ETC experienced a technical change in control when Richard Hogan, a partner at Yorkville ETF Holdings, LLC, the holding company that owns the majority of ETC, bought out 100% of the interest of Darren Schuringa, the other significant partner at Yorkville ETF Holdings. As a practical matter, this has no impact on the day-to-day operations of ETC or the Funds, but under SEC regulations, because more than 25% of ETC ownership changed hands, it resulted in the automatic termination of all of the advisory and sub-advisory agreements to which ETC is a party. These are the agreements that allow ETC to serve as adviser to the Funds, and by which ETC retains sub-advisers to manage those portfolios. We are asking you to vote to put new, similar agreements back in place so ETC can continue to manage the Funds just as before.

Because we are required to seek this vote from shareholders for the change in control mentioned above, we are taking the opportunity to seek your approval of two additional items. On June 1, 2014, our Trusts elected Timothy Jacoby to be a new independent trustee. Tim comes to us with deep experience in financial statement audit and related matters and has been a valuable addition to the Funds’ Boards of Trustees. We ask that you vote to approve him for those Funds that were already trading prior to his arrival.

1

Lastly, we recently requested and obtained a type of exemption from the SEC, commonly referred to as “manager of managers” exemptive relief, which would allow us to replace sub-advisers without the cost and time associated with a proxy. We are asking you to approve the Funds’ use of the exemption, which would help to ensure that the Funds are getting the best possible service and support from their sub-advisers without regard to the hassle and expense associated with making a change that would normally require a shareholder vote. Keep in mind that any change we make will not affect a Fund’s overall investment advisory fee paid by you. Even with this manager of managers relief, we cannot raise the overall investment advisory fee without your vote and this will not change that fact.

If you have received this mailing, you are a shareholder of record as of March 27, 2015 of one or more of our Funds. You are entitled to vote at the shareholder meeting and any additional adjournments of that meeting. Each Trust’s Board of Trustees recommends that you vote in favor of all of these proposals.

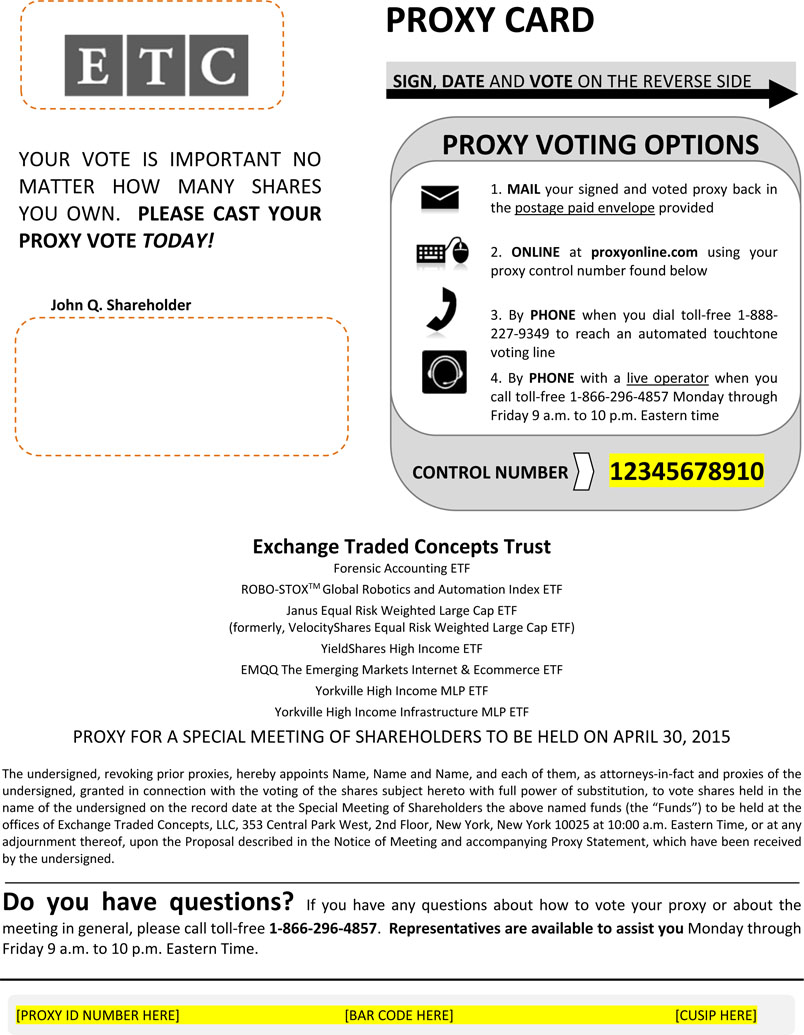

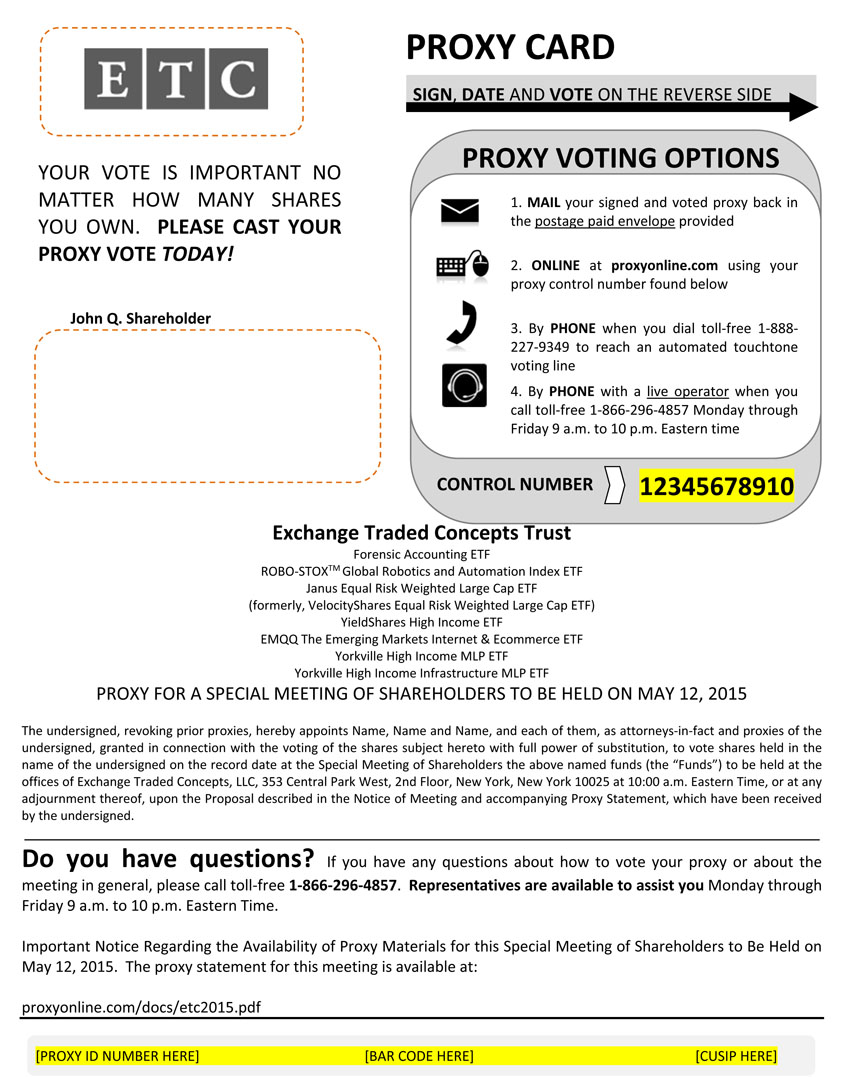

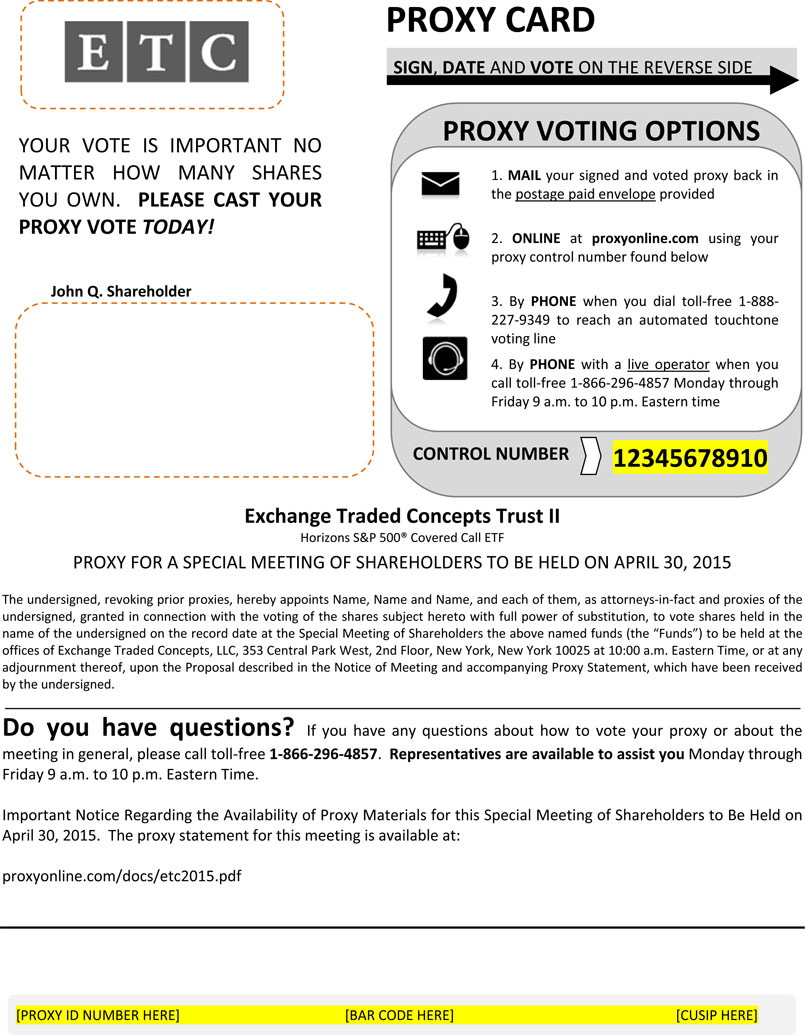

You can vote any one of these four ways:

| · | By mail with the enclosed proxy |

| · | Through the website listed on the proxy voting instructions enclosed; |

| · | By telephone using the toll-free number listed in the proxy voting instructions; or |

| · | In person at the shareholder meeting on May |

We encourage you to please vote through the website or telephone numbers provided, using the voting control number that appears on your proxy card enclosed. Your vote is extremely important to us. If you have questions, please call [xxx-xxx-xxxx] for additional information.1-866-296-4857. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

We appreciate your support and prompt response in this matter and look forward to continuing to serve these Funds.

Respectfully,

J. Garrett Stevens

Chief Executive Officer

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

2

EXCHANGE TRADED CONCEPTS TRUST

2545 South Kelly Avenue, Suite C, Edmond, Oklahoma 73013

EXCHANGE TRADED CONCEPTS TRUST II

2545 South Kelly Avenue, Suite C, Edmond, Oklahoma 73013

Notice of Joint Special Meeting of Shareholders

To Be Held on May 11,12, 2015

A joint special meeting (the “Meeting”) of the shareholders of each series (each, a “Fund” and collectively, the “Funds”) of Exchange Traded Concepts Trust and Exchange Traded Concepts Trust II (each, a “Trust” and collectively, the “Trusts”), will be held at the offices of Exchange Traded Concepts, LLC, 353 Central Park West, New York, New York 10025, on May 11,12, 2015 at 10:00 a.m. Eastern Time. You are being asked to vote separately on each proposal solely with respect to the Fund(s) that you own.

Proposal | Shareholders Solicited to Vote | |

| 1A. | To approve a new investment advisory agreement between Exchange Traded Concepts Trust and Exchange Traded Concepts, LLC (the “Adviser”). | Forensic Accounting ETF ROBO-STOXTM Global Robotics and Automation Index ETF Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) YieldShares High Income ETF EMQQ The Emerging Markets Internet & Ecommerce ETF Yorkville High Income MLP ETF Yorkville High Income Infrastructure MLP ETF |

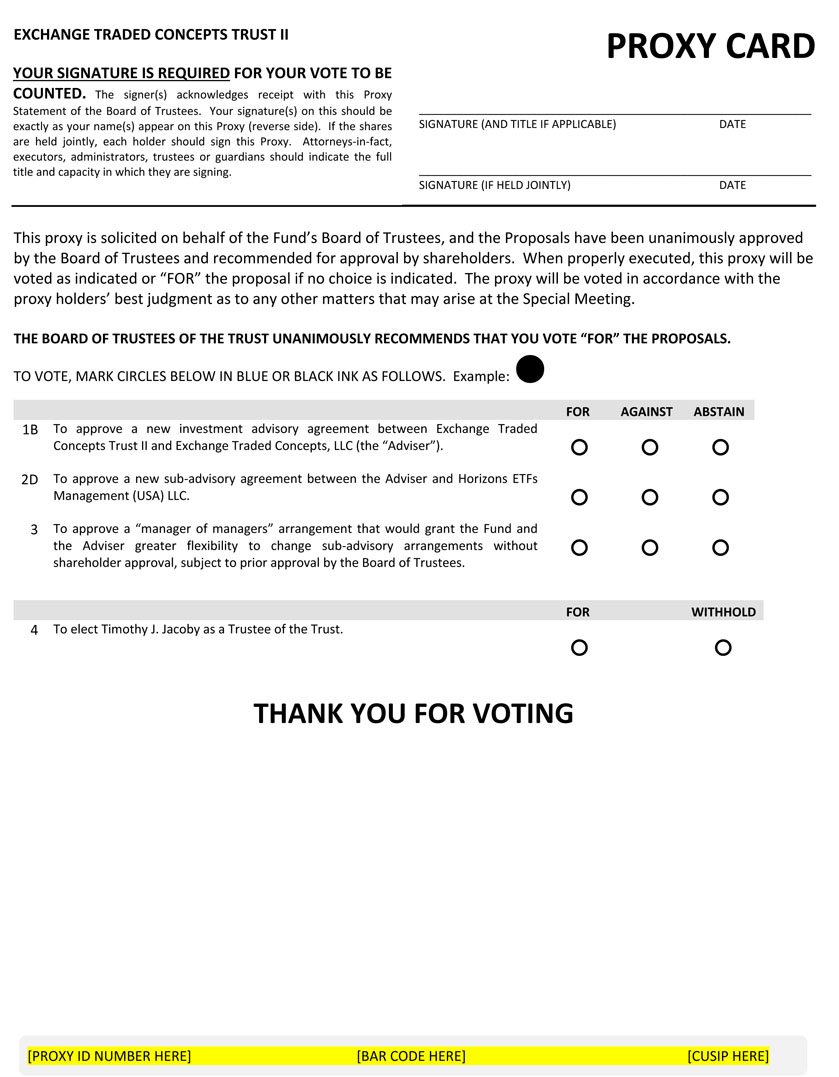

| 1B. | To approve a new investment advisory agreement between Exchange Traded Concepts Trust II and the Adviser. | Horizons S&P 500® Covered Call ETF |

| 2A. | To approve a new sub-advisory agreement between the Adviser and Vident Investment Advisory LLC. | Forensic Accounting ETF ROBO-STOXTM Global Robotics and Automation Index ETF Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) YieldShares High Income ETF |

| 2B. | To approve a new sub-advisory agreement between the Adviser and Penserra Capital Management LLC. | EMQQ The Emerging Markets Internet & Ecommerce ETF Yorkville High Income MLP ETF Yorkville High Income Infrastructure MLP ETF |

3

Proposal | Shareholders Solicited to Vote | |

| 2C. | To approve a new sub-advisory agreement between the Adviser and Yorkville ETF Advisors, LLC. | Yorkville High Income MLP ETF Yorkville High Income Infrastructure MLP ETF |

| 2D. | To approve a new sub-advisory agreement between the Adviser and Horizons ETFs Management (USA) LLC. | Horizons S&P 500® Covered Call ETF |

| 3. | To approve a “manager of managers” arrangement that would grant the Fund and the Adviser greater flexibility to change sub-advisory arrangements without shareholder approval, subject to prior approval by the Board of Trustees. | Forensic Accounting ETF ROBO-STOXTM Global Robotics and Automation Index ETF Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) YieldShares High Income ETF Horizons S&P 500® Covered Call ETF |

| 4. | To elect Timothy J. Jacoby as a Trustee of each Trust. | All Funds |

| 5. | To transact such other business as may properly come before the Meeting. | All Funds |

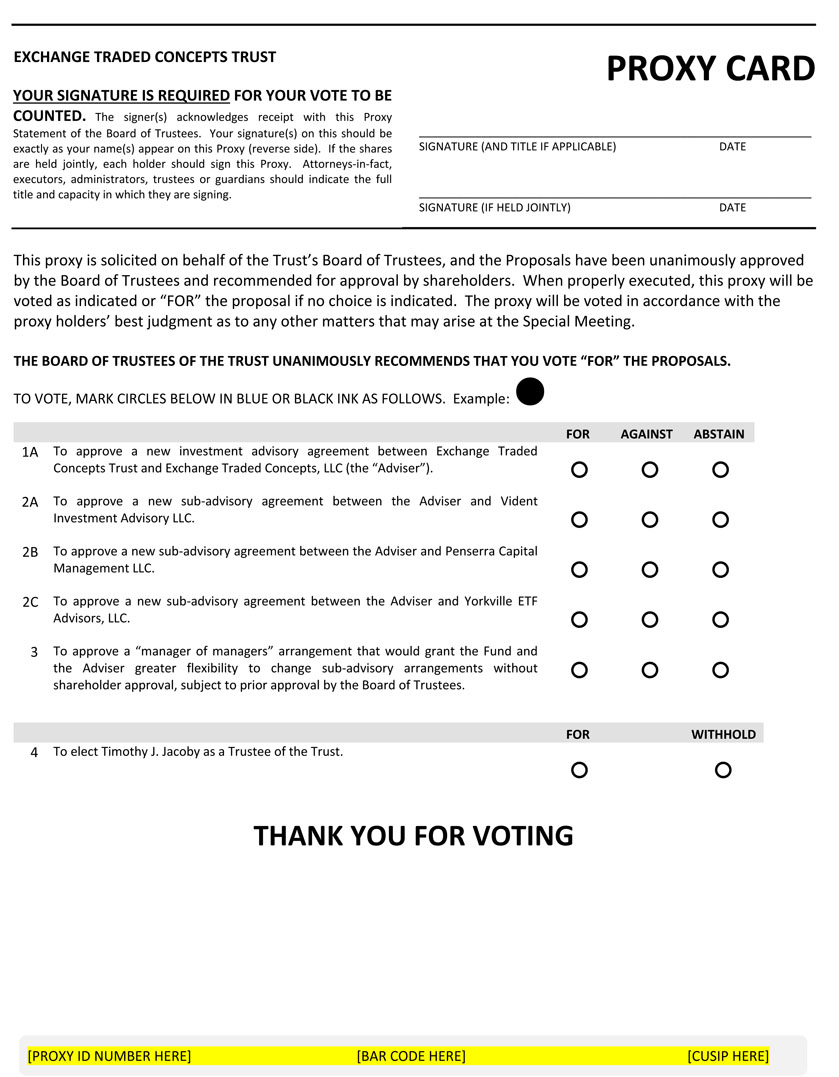

After careful consideration, each Trust’s Board of Trustees unanimously recommends that shareholders vote “FOR” each of the proposals listed above.

Shareholders of record of the Funds at the close of business on March 27, 2015 are entitled to notice of, and to vote at, the Meeting or any adjournment(s) thereof. Shareholders of each Fund will vote separately from shareholders of each other Fund with respect to Proposals 1, 2 and 3. Shareholders of each Fund in Exchange Traded Concepts Trust will vote together as a group with respect to Proposal 4. Similarly,Only shareholders of each Fund inthe Horizons S&P 500® Covered Call ETF will vote on Proposal 4 with respect to Exchange Traded Concepts Trust II will vote together as a group with respect to Proposal 4.II. Each proposal will be implemented if approved by shareholders and is not contingent on the approval of any other proposal.

We call your attention to the accompanying Proxy Statement. Your vote is very important to us regardless of the number of votes you hold. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting via telephone or the Internet if you wish to take advantage of these voting options. Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Trusts prior to the Meeting, or by voting in person at the Meeting.

By Order of the Boards of Trustees, J. Garrett Stevens President |

4

Dated: April 3, 2015

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF VOTES YOU HOLD. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD BE RETURNED PROMPTLY.

FOR YOUR CONVENIENCE, YOU MAY ALSO VOTE BY TELEPHONE OR INTERNET BY FOLLOWING THE ENCLOSED INSTRUCTIONS. IF YOU VOTE BY TELEPHONE OR VIA THE INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD UNLESS YOU ELECT TO CHANGE YOUR VOTE.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE MEETING TO BE HELD ON MAY 11,12, 2015

This Proxy Statement is available on the internet at [ ].proxyonline.com/docs/etc2015.pdf.

Fund shareholders can find important information about the Funds in their annual reports. Each Fund will furnish, without charge, a copy of the most recent annual report and the most recent semi-annual report succeeding such annual report, if any, to a Fund shareholder upon request. You may obtain copies of these reports by writing to the TrustTrusts at the address set forth on the cover page to this Proxy Statement or by calling the Fund or visiting the Fund’s website as set forth below.

Shareholders of the Forensic Accounting ETF can request the Fund’s annual report, dated November 30, 2014, by calling the Fund at 1-855-545-FLAG or visiting www.flagetf.com.

Shareholders of the ROBO-STOXTM Global Robotics and Automation Index ETF can request the Fund’s annual report, dated April 30, 2014, by calling the Fund at 1-855-456-ROBO or visiting www.robostoxetfs.com.

Shareholders of the Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) can request the Fund’s annual report, dated April 30, 2014, by calling the Fund at 1-877-583-5624 or visiting https://www.janus.com/advisor/exchange-traded-funds/janus-equal-risk-weighted-large-cap-etf/commentary-and-literature.

A shareholder report is not yet available for EMQQ The Emerging Markets Internet & Ecommerce ETF. Shareholders of the Fund can request the Fund’s annual or semi-annual report, when available, by calling the Fund at 1-855-888-9892 or visiting www.emqqetf.com.

5

Shareholders of the Yorkville High Income MLP ETF and the Yorkville High Income Infrastructure MLP ETF can request the Funds’ annual report, dated November 30, 2014, by calling the Funds at 1-855-YES-YETF or visiting www.yetfs.com.

Shareholders of the YieldShares High Income ETF can request the Fund’s annual report, dated December 31, 2013, by calling the Fund at 1-855-796-3863 or visiting www.yieldshares.com.

Shareholders of the Horizons S&P 500® Covered Call ETF can request the Fund’s annual report, dated April 30, 2014, by calling the Funds at 1-855-HZN-ETFS or visiting www.us.horizonsetfs.com.

6

EXCHANGE TRADED CONCEPTS TRUST

Forensic Accounting ETF

ROBO-STOXTM Global Robotics and Automation Index ETF

Janus Equal Risk Weighted Large Cap ETF

(formerly, VelocityShares Equal Risk Weighted Large Cap ETF)

YieldShares High Income ETF

EMQQ The Emerging Markets Internet & Ecommerce ETF

Yorkville High Income MLP ETF

Yorkville High Income Infrastructure MLP ETF

2545 South Kelly Avenue, Suite C, Edmond, Oklahoma 73013

EXCHANGE TRADED CONCEPTS TRUST II

Horizons S&P 500® Covered Call ETF

2545 South Kelly Avenue, Suite C, Edmond, Oklahoma 73013

JOINT PROXY STATEMENT

Joint Special Meeting of Shareholders

To be Held on May 11,12, 2015

This Joint Proxy Statement and enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the Boards of Trustees of Exchange Traded Concepts Trust and Exchange Traded Concepts Trust II (each, a “Trust” and together, the “Trusts”)). The proxies are being solicited for use at a Joint Special Meeting of Shareholders of the Trusts to be held at the offices of Exchange Traded Concepts, LLC, 353 Central Park West, New York, New York 10025, on May 11,12, 2015 at 10:00 a.m. Eastern Time (the “Meeting”), and at any and all adjournments or postponements thereof.

The Board of Trustees of the Trusts (each, a “Board” and collectively, the “Boards”) have called the Meeting and are soliciting proxies from shareholders of each series of the Trusts (each, a “Fund” and collectively, the “Funds”) for the purposes listed below:

7

Proposal | Shareholders Solicited to Vote | |

| 1A. | To approve a new investment advisory agreement between Exchange Traded Concepts Trust and Exchange Traded Concepts, LLC (the “Adviser”). | Forensic Accounting ETF ROBO-STOXTM Global Robotics and Automation Index ETF Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) YieldShares High Income ETF EMQQ The Emerging Markets Internet & Ecommerce ETF Yorkville High Income MLP ETF Yorkville High Income Infrastructure MLP ETF |

| 1B. | To approve a new investment advisory agreement between Exchange Traded Concepts Trust II and the Adviser. | Horizons S&P 500® Covered Call ETF |

| 2A. | To approve a new sub-advisory agreement between the Adviser and Vident Investment Advisory LLC. | Forensic Accounting ETF ROBO-STOXTM Global Robotics and Automation Index ETF Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) YieldShares High Income ETF |

| 2B. | To approve a new sub-advisory agreement between the Adviser and Penserra Capital Management LLC. | EMQQ The Emerging Markets Internet & Ecommerce ETF Yorkville High Income MLP ETF Yorkville High Income Infrastructure MLP ETF |

| 2C. | To approve a new sub-advisory agreement between the Adviser and Yorkville ETF Advisors, LLC. | Yorkville High Income MLP ETF Yorkville High Income Infrastructure MLP ETF |

| 2D. | To approve a new sub-advisory agreement between the Adviser and Horizons ETFs Management (USA) LLC. | Horizons S&P 500® Covered Call ETF |

| 3. | To approve a “manager of managers” arrangement that would grant the Fund and the Adviser greater flexibility to change sub-advisory arrangements without shareholder approval, subject to prior approval by the Board of Trustees. | Forensic Accounting ETF ROBO-STOXTM Global Robotics and Automation Index ETF Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) YieldShares High Income ETF Horizons S&P 500® Covered Call ETF |

8

Proposal | Shareholders Solicited to Vote | |

| 4. | To elect Timothy J. Jacoby as a Trustee of each Trust. | All Funds |

| 5. | To transact such other business as may properly come before the Meeting. | All Funds |

This Proxy Statement and the accompanying notice and the proxy card are being first mailed to shareholders on or about [ ].April 3, 2015.

You are entitled to vote at the Meeting for each Fund share you held as the shareholder of record as of the close of business on March 27, 2015 (the “Record Date”). Shareholders of each Fund will vote separately from shareholders of each other Fund with respect to Proposals 1, 2 and 3. Shareholders of each Fund in Exchange Traded Concepts Trust will vote together as a group with respect to Proposal 4. Similarly,Only shareholders of each Fund inthe Horizons S&P 500® Covered Call ETF will vote on Proposal 4 with respect to Exchange Traded Concepts Trust II will vote together as a group with respect to Proposal 4.II. Each proposal will be implemented if approved by shareholders and is not contingent on the approval of any other proposal.

If you have any questions about the Proposal or about voting, please call [Proxy Solicitor Information].1-866-296-4857. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

9

TABLE OF CONTENTS

| Proposal 1: Approval of New Investment Advisory Agreements | 12 |

| Background | 12 |

| Information Relating to Proposal 1A | 14 |

| Information Relating to Proposal 1B | 21 |

| Proposal 2: Approval of New Sub-Advisory Agreements | 28 |

| Background | 28 |

| Information Relating to Proposal 2A | 31 |

| Information Relating to Proposal 2B | 39 |

| Information Relating to Proposal 2C | 46 |

| Information Relating to Proposal 2D | 52 |

| Proposal 3: Approval of a “Manager of Managers” Arrangement | 58 |

| Background | 58 |

| Benefit to the Funds | 58 |

| Effect on Fees and Quality of Advisory Services | 59 |

| Conditions for Establishing a Manager of Managers Arrangement | 59 |

| Required Vote | 60 |

| Proposal 4: Election of a Trustee to the Board of Trustees of | |

| Exchange Traded Concepts Trust and Exchange Traded Concepts Trust II | 61 |

| Background | 61 |

| Information Relating to Proposals 4A and 4B | 61 |

| Information Relating to Proposal 4A | 65 |

| Information Relating to Proposal 4B | 70 |

| Other Business | 75 |

| Appendix A - Executive Officers and Directors of the Adviser | 78 |

10

EXHIBITS

Exhibit A: Form of Proposed Advisory Agreement between Exchange Traded Concepts Trust and Exchange Traded Concepts, LLC | 79 |

Exhibit B: Form of Proposed Advisory Agreement between Exchange Traded Concepts Trust II and Exchange Traded Concepts, LLC | 90 |

Exhibit C: Form of Proposed Sub-Advisory Agreement between Exchange Traded Concepts, LLC and Vident Investment Advisory LLC | |

Exhibit D: Form of Proposed Sub-Advisory Agreement between Exchange Traded Concepts, LLC and Penserra Capital Management LLC | 116 |

Exhibit E: Form of Proposed Sub-Advisory Agreement between Exchange Traded Concepts, LLC and Yorkville ETF Advisors, LLC | 130 |

Exhibit F: Form of Proposed Sub-Advisory Agreement between Exchange Traded Concepts, LLC and Horizons ETFs Management (USA) LLC | 145 |

Exhibit G: | 160 |

Exhibit H: Nominating Committee Charter of Exchange Traded Concepts Trust | 162 |

Exhibit I: Nominating Committee Charter of Exchange Traded Concepts Trust II | 166 |

| Exhibit J: Information Concerning Auditors and Audit Committees of Exchange Traded Concepts Trust and Exchange Traded Concepts Trust II | |

Exhibit K: Outstanding Shares | 181 |

Exhibit L: | 182 |

11

PROPOSAL 1

Approval of New Investment Advisory Agreements

Proposals 1A and 1B (collectively, “Proposal 1”) relate to actions that need to be taken in response to a transaction (the “Transaction”) that changed the controlling interests of Exchange Traded Concepts, LLC, the investment adviser to each of the Funds (the “Adviser”).

The Investment Company Act of 1940 (the “1940 Act”) provides that a fund’s investment advisory agreement must terminate whenever there is a “change in control” of the investment adviser. The Transaction resulted in a change in control of the Adviser. In order for the Adviser to continue serving as investment adviser to the Funds, new investment advisory agreements must be approved to replace those that automatically terminated as a result of the Transaction. For that reason, we are seeking shareholder approval of a new investment advisory agreement for each of the Funds.

Background

The Adviser has provided investment advisory services to each Fund since inception. The proposal to approve a new investment advisory agreement between each of the Trusts, on behalf of the Funds, and the Adviser (each, a “Proposed Advisory Agreement”) stems from a change in control of the Adviser and its parent company, Yorkville ETF Holdings, LLC (“Yorkville”). Yorkville is located at 353 Central Park West, 2nd Floor, New York City, New York 10025. Yorkville is the sole controlling owner of the Adviser by virtue of its ownership of at least 75% of the Adviser’s outstanding equity interests. Prior to the Transaction, Yorkville was controlled directly by Darren R. Schuringa, by virtue of his ownership of more than 25% of Yorkville’s outstanding equity interests, and indirectly by Richard Hogan through the Richard Hogan Trust, by virtue of that Trust’s ownership of more than 25% of Yorkville’s outstanding equity interests. As a result of their ownership of Yorkville and Yorkville’s ownership of the Adviser, Messrs. Hogan and Schuringa may have each been deemed indirect control persons of the Adviser by virtue of their indirect ownership of at least 25% of the Adviser’s outstanding equity interests.

On January 15, 2015, Yorkville acquired 100% of Mr. Schuringa’s interest in Yorkville, leaving Mr. Hogan, through the Richard Hogan Trust, as the controlling shareholder of Yorkville. The Adviser has informed each of the Boards that no changes are planned to the management or operations of the Adviser as a result of the Transaction. Under the 1940 Act, this Transaction resulted in a change in control of the Adviser. Section 2(a)(4) of the 1940 Act provides that a change in control of an investment adviser causes an assignment of that adviser’s investment advisory contracts, and Section 15(a) of the 1940 Act provides that an investment advisory contract must automatically terminate upon its assignment. Accordingly, the Transaction resulted in the automatic termination of the investment advisory agreements pursuant to which the Adviser had previously provided investment advisory services to each of the Funds (each, an “Old Advisory Agreement”).

In anticipation of the Transaction, at a special in-person meeting held on December 19, 2014, the Boards, including a majority of the Trustees who are not “interested persons” of the Funds within the meaning of Section 2(a)(19) of the 1940 Act (the “Independent Trustees”), approved interim investment advisory agreements between each Trust, on behalf of the Funds, and the Adviser (each, an “Interim Advisory Agreement”). As permitted by the 1940 Act, the Adviser continued serving as investment adviser to the Funds upon completion of the Transaction pursuant to the Interim Advisory Agreements. The Interim Advisory Agreements have the same advisory fee rate and otherwise are the same in all material respects as the Old Advisory Agreements, except that, as required by the 1940 Act, the Interim Advisory Agreements have a term of up to 150 days and require that compensation payable to the Adviser be kept in an escrow account pending shareholder approval of new advisory agreements. If the Proposed Advisory Agreements are not approved by Fund shareholders, the Adviser will be entitled to be paid the lesser of any costs incurred in performing under the Interim Advisory Agreement and the total amount in the escrow account.

12

The Proposed Advisory Agreements require shareholder approval, without which the Adviser will not be able to continue serving as investment adviser once the Interim Advisory Agreements expire. At a meeting on January 22, 2015, the Boards, including a majority of the Independent Trustees, approved the Proposed Advisory Agreements and recommended that they be submitted to Fund shareholders for approval.

The Proposed Advisory Agreements are the same in all material respects as the Old Advisory Agreements. The Adviser has informed the Trusts that no changes are planned to the management or operations of the Adviser as a result of the Transaction and that the services provided by the Adviser to the Funds will not be affected by the Transaction.

13

Information Relating to Proposal 1A

Proposed Advisory Agreement between

Exchange Traded Concepts Trust and Exchange Traded Concepts, LLC

Forensic Accounting ETF

ROBO-STOXTM Global Robotics and Automation Index ETF

Janus Equal Risk Weighted Large Cap ETF

YieldShares High Income ETF

EMQQ The Emerging Markets Internet & Ecommerce ETF

Yorkville High Income MLP ETF

Yorkville High Income Infrastructure MLP ETF

The Old Advisory Agreement between Exchange Traded Concepts Trust (the “Trust”) and the Adviser, dated March 2, 2012, on behalf of each Fund (each, a “Fund” and collectively, the “Funds”), was approved by each Fund’s initial shareholder on the dates shown below, and was not subsequently submitted to a vote of Fund shareholders. The Old Advisory Agreement with respect to all Funds except EMQQ The Emerging Markets Internet & Ecommerce ETF was renewed by the Trust’s Board of Trustees (the “Board”) on February 18, 2014. The Old Advisory Agreement with respect to EMQQ The Emerging Markets Internet & Ecommerce ETF was approved by the Board on November 11, 2014.

| Fund | Shareholder Approval Date |

| Forensic Accounting ETF | January 30, 2013 |

ROBO-STOXTM Global Robotics and Automation Index ETF | October 16, 2013 |

| Janus Equal Risk Weighted Large Cap ETF | July 28, 2013 |

| YieldShares High Income ETF | June 11, 2012 |

| EMQQ The Emerging Markets Internet & Ecommerce ETF | November 11, 2014 |

| Yorkville High Income MLP ETF | March 1, 2012 |

| Yorkville High Income Infrastructure MLP ETF | February 11, 2013 |

A copy of the form of the Proposed Advisory Agreement between Exchange Traded Concepts Trust and the Adviser is attached to this Proxy Statement as Exhibit A.

Description of the Proposed Advisory Agreement. The following description of the material terms of the Proposed Advisory Agreement is only a summary and is qualified in its entirety by reference to Exhibit A.

Duration and Termination. The Proposed Advisory Agreement, like the Old Advisory Agreement, will remain in effect for a period of two years, unless sooner terminated. After the initial two-year period, continuation of the Proposed Advisory Agreement from year to year is subject to annual approval by the Board, including at least a majority of the Independent Trustees. The Interim Advisory Agreement will remain in effect for a period of up to 150 days, unless sooner terminated.

14

Like the Old Advisory Agreement, the Proposed Advisory Agreement may be terminated without penalty (i) by vote of a majority of the Board, or by vote of a majority of the outstanding voting securities of a Fund or (ii) by the Adviser by not more than sixty (60) days’ nor less than thirty (30) days’ written notice to the Trust.

Advisory Services. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement require that the Adviser (i) provide the Funds with investment research, advice and supervision and furnish continuously an investment program for the Funds, consistent with each Fund’s investment objective and policies; (ii) oversee the day-to-day operations of the Funds, subject to the direction and control of the Board and the officers of the Trust; (iii) if it exercises its authority under the agreements to select and retain sub-advisers to the Funds, supervise the activities of the sub-advisers; (iv)administer the Funds’ business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services, and provides its officers and employees to serve as officers or Trustees of the Trust; and (v)(iv) bear the costs of all advisory and non-advisory services required to operate the Funds, except Excluded Expenses, as defined below, in exchange for a single unitary management fee. In addition, the Adviser is responsible for arranging transfer agency, custody, fund administration, securities lending, accounting, and other non-distribution related services necessary for the Funds to operate; (v) administeroperate. The Adviser also administers the Funds’ business affairs, provideprovides office facilities and equipment and certain clerical, bookkeeping and administrative services, and provideprovides its officers and employees to serve as officers or Trustees of the Trust.

Management Fees. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement provide that the Adviser receives a unitary management fee based on each Fund’s average daily net assets at the annual rate set forth in the table below. The fee is computed daily and paid monthly. The aggregate amount of advisory fees paid to the Adviser by each Fund for the Fund’s last fiscal period is also set forth in the table below.

| Fund | Advisory Fee Rate | Aggregate Amount of Advisory Fees Paid to the Adviser by the Fund |

| Forensic Accounting ETF | 85 bps | $101,0751 |

Robo-StoxTM Global Robotics and Automation Index ETF | 95 bps | $320,7812 |

| Janus Equal Risk Weighted Large Cap ETF | 65 bps | $110,9053 |

| YieldShares High Income ETF | 50 bps | $277,7544 |

| EMQQ The Emerging Markets Internet & Ecommerce ETF | 86 bps | $05 |

| Yorkville High Income MLP ETF | 82 bps | $2,419,5161 |

| Yorkville High Income Infrastructure MLP ETF | 82 bps | $322,2931 |

| 1 | For the fiscal year ended November 30, 2014. |

| 2 | For the fiscal period beginning October 21, 2013 (commencement of operations) through April 30, 2014. |

| 3 | For the fiscal period beginning July 29, 2013 (commencement of operations) through April 30, 2014. |

| 4 | For the fiscal year ended December 31, 2014. |

| 5 | The Fund was not in operation during the fiscal year ended August 31, 2014. |

15

The Interim Advisory Agreement differs from the Old Advisory Agreement and Proposed Advisory Agreement in that, as required by Rule 15a-4 under the 1940 Act, compensation payable to the Adviser will be kept in an escrow account pending shareholder approval of a new advisory agreement. If the Proposed Advisory Agreement is not approved by Fund shareholders, the Adviser will be entitled to be paid the lesser of any costs incurred in performing the interim contract and the total amount in the escrow account.

Brokerage Policies. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement authorize the Adviser to select (or oversee a sub-adviser’s selection of) the brokers or dealers that will execute the purchases and sales of securities of the Fund and direct the Adviser to seek (or oversee a sub-adviser that will seek) for the Funds the most favorable execution and net price available under the circumstances. The Adviser (or a sub-adviser) may cause the Funds to pay a broker a commission in excess of that which another broker might have charged for effecting the same transaction, in recognition of the value of the brokerage and research services provided by the broker to the sub-adviser.

For each Fund’s most recently completed fiscal period, no Fund paid commissions on portfolio brokerage transactions to brokers who may be deemed to be affiliated persons of the Fund or the Adviser or affiliated persons of such persons.

Payment of Expenses. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement provide that the Adviser will bear its own costs of providing services under the agreement and is obligated to pay all expenses incurred by the Funds except for the fee paid to the Adviser pursuant to the Agreement, interest, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act (collectively, “Excluded Expenses”).

Other Provisions. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement provide that the Adviser shall indemnify and hold harmless the Trust, its affiliated persons, and controlling persons against any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) by reason of or arising out of the Adviser’s willful misfeasance, bad faith or gross negligence generally in the performance of its duties, or by reason of the reckless disregard of its obligations and duties under the agreement. All other litigation arising out of the agreement, or any and every other nature, shall be satisfied solely out of the assets of the Funds, and the Adviser shall not be subject to liability to the Trust or the Funds or to any shareholder of the Funds for any act or omission in the course of, or connected with, rendering services under the agreement or for any losses that may be sustained in the purchase, holding or sale of any security by the Funds.

Executive Officers and Directors of the Adviser. Information regarding the principal executive officers and directors of the Adviser is set forth in Appendix A.

16

Other Funds with Similar Investment Objectives Managed by the Adviser. Below is a list of other funds with similar investment objectives as the Funds managed by the Adviser, the size of each other fund and the rate of the Adviser’s compensation with respect to each other fund. The advisory fee for each fund listed is a unitary management fee based on each fund’s average daily net assets at the annual rate set forth in the table below. The fee is computed daily and paid monthly. The other funds’ investment objectives are similar to the Funds in that each fund’s investment objective is to seek to track, before fees and expenses, the performance of an underlying index, which is also listed below.

| Fund | Advisory Fee Rate | Assets of 12/31/14 | Underlying Index |

| Horizons S&P 500 Covered Call ETF | 65 bps | $32,022,219 | S&P 500 Stock Covered Call Index1 |

| Source EURO STOXX 50 ETF | The greater of a minimum fee of $250,000, or 4 bps on the first $1.5 billion; 2 bps on the next $2.5 billion; and 1.5 bps on assets over $4 billion.4 | $38,404,956 | EURO STOXX 50 Net Return Index (USD)3 |

| AlphaClone Alternative Alpha ETF | 95 bps | $88,872,433 | AlphaClone Hedge Fund Long/Short Index5 |

| Vident International Equity Fund | 75 bps | $696,516,034 | Vident International Equity Index6 |

| Vident Core U.S. Equity Fund | 55 bps | $297,573,181 | Vident Core U.S. Equity Index7 |

| Deep Value ETF | 80 bps | $214,550,445 | Tiedemann Wealth Management Deep Value Index8 |

| Falah Russell-IdealRatings U.S. Large Cap ETF | 70 bps | $1,288,874 | Russell-IdealRatings Islamic U.S. Large Cap Total Return Index9 |

| Vident Core U.S. Bond Strategy ETF | 45 bps | $367,471,656 | Vident Core U.S. Bond Strategy Index10 |

1. Comprised of all of the equity securities in the S&P 500 Index and short (written) call options on up to 100% of each of the option eligible securities in the S&P 500 Index.

2. Comprised of all of the equity securities in the S&P Financial Select Sector Index and short (written) call options on up to 100% of each of the option eligible securities in the S&P Financial Select Sector Index.

3. Comprised of equity securities designed to represent the performance of some of the largest companies across various sectors in Europe.

17

4 In addition, if the combined average daily net assets of all series in the Source ETF Trust is greater than $1 billion on September 16, 2016, the management fee from Source will be: 4 bps on the first $500 million; 3 bps on the next $1 billion; 2 bps on the next $2.5 billion; and 1.5 bps on assets over $4 billion.

5. Comprised of U.S. equity securities selected based on a proprietary hedge fund position replication methodology.

6. Comprised of emerging market securities selected by various governance screens.

7. Comprised of domestic equities selected by various governance screens.

8. Comprised of large capitalization securities selected based on various valuation metrics.

9. Comprised of the common stock of Shariah compliant large capitalization U.S. companies.

10. Comprised of fixed income securities selected by various governance screens.

Required Vote. Approval of Proposal 1A with respect to each Fund requires the affirmative vote of a “majority of the outstanding voting securities” of such Fund when a quorum is present. Under the 1940 Act, a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the shares of the Fund present or represented by proxy at the Meeting if the holders of more than 50% of the outstanding shares are present or represented by proxy at the Meeting, or (b) more than 50% of the outstanding shares. If Proposal 1A is approved by a Fund’s shareholders, the Proposed Advisory Agreement, with respect to such Fund, is expected to become effective on the date of the Meeting.

If Proposal 1A is not approved by a Fund’s shareholders, the Adviser will continue to serve as investment adviser to such Fund pursuant to the Interim Advisory Agreement, and the Board will consider alternatives for the Fund, including seeking subsequent approval of a new investment advisory agreement by Fund shareholders. Approval of the Proposed Advisory Agreement by shareholders of one Fund is not contingent on approval of the Proposed Advisory Agreement by shareholders of any other Fund.

Recommendation of the Board of Trustees. The Board believes that the terms and conditions of the Proposed Advisory Agreement are fair to, and in the best interests of, each Fund and its shareholders. The Board believes that, upon a Fund’s shareholder approval of Proposal 1A, the Adviser will continue providing such Fund the same level of services as it provided under the Old Advisory Agreement and currently provides under the Interim Advisory Agreement. The Board was presented with information demonstrating that the Proposed Advisory Agreement would enable Fund shareholders to continue to obtain quality services at a cost that is fair and reasonable.

In considering the Proposed Advisory Agreement, the Board took into consideration (i) the nature, extent and quality of the services to be provided by the Adviser; (ii) the historical performance of each Fund; (iii) the Adviser’s expected cost and profits realized from providing such services, including any fall-out benefits enjoyed by the Adviser or its affiliates; (iv) comparative fee and expense data for each Fund; (v) the extent to which the advisory fee for a Fund reflects economies of scale shared with Fund shareholders; and (vi) other factors the Board deemed to be relevant. In their deliberations, the Board did not identify any single piece of information discussed below that was all-important, controlling or determinative of its decision.

18

Nature, Extent and Quality of Services Provided. The Board considered the Adviser’s specific responsibilities in all aspects of day-to-day management of the Funds, such as providing portfolio investment management services. The Board noted that the services to be provided under the Proposed Advisory Agreement were identical in all material respects to those services provided under the Old Advisory Agreement and Interim Advisory Agreement. In particular, they noted that the Adviser has served as each Fund’s investment adviser since its inception.

In considering the nature, extent and quality of the services to be provided by the Adviser, the Board considered the quality of the Adviser’s compliance infrastructure. The Board also considered the Adviser’s experience working with ETFs, including the Funds and other series of the Trust. The Board noted that it had previously received a copy of the Adviser’s registration form (“Form ADV”), as well as the response of the Adviser to a detailed series of questions which included, among other things, information about the background and experience of the firm’s management and staff. The Board also considered the overall quality of the Adviser’s personnel, operations, financial condition, and investment advisory capabilities.

The Board considered other services provided to the Funds, such as overseeing the activities of the Funds’ investment sub-advisers and monitoring compliance with various Fund policies and procedures and with applicable securities regulations. Based on the factors above, as well as those discussed below, the Board concluded that it was satisfied with the nature, extent and quality of the services to be provided to each Fund by the Adviser.

Historical Performance. The Board then considered the past performance of each Fund, including the Funds with limited historical performance. The Board noted that the index-based investment objective of each Fund made analysis of investment performance, in absolute terms, less of a priority than that which normally attaches to the performance of actively managed funds. Instead, the Board focused on the extent to which each Fund achieved its investment objective as a passively managed fund. In that regard, the Board reviewed information regarding factors impacting the performance of the Funds, including the construction of their underlying indices and the addition or deletion of securities from the underlying indices. The Board reviewed the information regarding each Fund’s index tracking, discussing, as applicable, factors which contributed to a Fund’s tracking error over certain periods of time. With respect to EMQQ The Emerging Markets Internet & Ecommerce ETF and the Forensic Accounting ETF, the Board noted that each Fund satisfactorily tracked its underlying index. With respect to the Yorkville High Income MLP ETF and the Yorkville High Income Infrastructure MLP ETF, the Board reviewed the information regarding each Fund’s index tracking, noting that each Fund’s tracking error, as anticipated by Yorkville Advisors, was attributable to the Fund’s taxation as a C corporation and that, after taking this into account, each Fund satisfactorily tracked its underlying index. With respect to the other Funds in the Trust, the Board noted that, while each Fund had underperformed its underlying index over certain periods as reflected in the meeting materials, each Fund’s recent performance was more in line with its underlying index and did not necessitate significant additional review. The Board further noted that it received regular reports from the Funds’ Adviser and sub-advisers regarding the Funds’ performance at its quarterly meetings.

19

Costs of Services Provided and Economies of Scale. The Board reviewed the advisory fees to be paid to the Adviser for its services to each Fund under the Proposed Advisory Agreement and compared the advisory fees to be paid by each Fund to those paid by comparable funds. The Board noted that each Fund’s advisory fees were consistent with the range of advisory fees paid by other peer funds.

The Board noted that the advisory fees payable under the Proposed Advisory Agreement were identical to the advisory fees paid under the Old Advisory Agreement. The Board took into consideration that the advisory fee for the Fund was a “unified fee,” meaning that the Fund would pay no expenses other than the Excluded Expenses. The Board noted that the Adviser would be responsible for compensating the Trust’s other service providers and paying each Fund’s other expenses out of its own fee and resources, except that Yorkville Advisors has agreed to assume the responsibility to pay the Yorkville Funds’ (as defined below) expenses out of its own fee and resources. The Board further noted, nevertheless, that the Adviser is ultimately responsible for ensuring that the obligation to the Yorkville Funds is satisfied. The Board considered the costs and expenses incurred by the Adviser in providing advisory services, evaluated the compensation and benefits expected to be received by the Adviser from its relationship with the Funds, and performed a profitability analysis with respect to each of the Funds. The Board concluded for each Fund that the advisory fees appeared reasonable in light of the services rendered. In addition, the Board considered for each Fund whether economies of scale have been realized. The Board concluded that no significant economies of scale have been realized by any of the Funds and that the Board will have the opportunity to periodically reexamine whether such economies have been achieved.

Conclusion. No single factor was determinative of the Board’s decision to approve the Proposed Advisory Agreement on behalf of each Fund; rather, the Board based its determination on the total mix of information available to it. Based on a consideration of all the factors in their totality, the Board, including a majority of the Independent Trustees, determined that the Proposed Advisory Agreement, including the compensation payable under the agreement, was fair and reasonable to each of the Funds. The Board, including a majority of the Independent Trustees, therefore determined that the approval of the Proposed Advisory Agreement was in the best interests of each Fund and its shareholders.

The Board of Trustees of Exchange Traded Concepts Trust unanimously recommends that

shareholders of each Fund vote “FOR” Proposal 1A.

20

Information Relating to Proposal 1B

Proposed Advisory Agreement between

Exchange Traded Concepts Trust II and Exchange Traded Concepts, LLC

Horizons S&P 500® Covered Call ETF

The Old Advisory Agreement between Exchange Traded Concepts Trust II (the “Trust”) and the Adviser, dated May 23, 2013, on behalf of the Horizons S&P 500® Covered Call ETF (the “Fund”), was approved by the Trust’s Board of Trustees (the “Board”) on May 23, 2013, was approved by the Fund’s initial shareholder on May 23, 2013, and was not subsequently submitted to a vote of Fund shareholders.

A copy of the form of the Proposed Advisory Agreement between Exchange Traded Concepts Trust II and the Adviser is attached to this Proxy Statement as Exhibit B.

Description of the Proposed Advisory Agreement. The following description of the material terms of the Proposed Advisory Agreement is only a summary and is qualified in its entirety by reference to Exhibit B.

Duration and Termination. The Proposed Advisory Agreement, like the Old Advisory Agreement, will remain in effect for a period of two years, unless sooner terminated. After the initial two-year period, continuation of the Proposed Advisory Agreement from year to year is subject to annual approval by the Board, including at least a majority of the Independent Trustees. The Interim Advisory Agreement will remain in effect for a period of up to 150 days, unless sooner terminated.

Like the Old Advisory Agreement, the Proposed Advisory Agreement may be terminated without penalty (i) by vote of a majority of the Board, or by vote of a majority of the outstanding voting securities of the Fund or (ii) by the Adviser by not more than sixty (60) days’ nor less than thirty (30) days’ written notice to the Trust.

Advisory Services. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement require that the Adviser (i) provide the Fund with investment research, advice and supervision and furnish continuously an investment program for the Fund, consistent with the Fund’s investment objective and policies; (ii) oversee the day-to-day operations of the Fund, subject to the direction and control of the Board and the officers of the Trust; (iii) if it exercises its authority under the agreements to select and retain sub-advisers to the Fund, supervise the activities of the sub-advisers; (iv) administer the Fund’s business affairs, provide office facilities and equipment and certain clerical, bookkeeping and administrative services, and provide its officers and employees to serve as officers or Trustees of the Trust; and (vi)(iv) bear the costs of all advisory and non-advisory services required to operate the Fund, except Excluded Expenses, as defined below, in exchange for a single unitary management fee. In addition, the Adviser is responsible for arranging transfer agency, custody, fund administration, securities lending, accounting, and other non-distribution related services necessary for the Horizons FundsFund to operate. The Adviser also administers the Fund’s business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services, and provides its officers and employees to serve as officers or Trustees of the Trust.

21

Management Fees. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement provide that the Adviser receives a unitary management fee based on the Fund’s average daily net assets at the annual rate set forth in the table below. The fee is computed daily and paid monthly. The aggregate amount of advisory fees paid to the Adviser by the Fund for the Fund’s last fiscal period is also set forth in the table below.

| Fund | Advisory Fee Rate | Aggregate Amount of Advisory Fees Paid to the Adviser by the Fund |

Horizons S&P 500® Covered Call ETF | 65 bps | $103,3481 |

| 1 | For the fiscal period beginning June 24, 2013 (commencement of operations) through April 30, 2014. |

The Interim Advisory Agreement differs from the Old Advisory Agreement and Proposed Advisory Agreement in that, as required by Rule 15a-4 under the 1940 Act, compensation payable to the Adviser will be kept in an escrow account pending shareholder approval of a new advisory agreement. If the Proposed Advisory Agreement is not approved by Fund shareholders, the Adviser will be entitled to be paid the lesser of any costs incurred in performing the interim contract and the total amount in the escrow account.

Brokerage Policies. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement authorize the Adviser to select (or oversee a sub-adviser’s selection of) the brokers or dealers that will execute the purchases and sales of securities of the Fund and direct the Adviser to seek (or oversee a sub-adviser that will seek) for the Fund the most favorable execution and net price available under the circumstances. The Adviser (or a sub-adviser) may cause the Fund to pay a broker a commission in excess of that which another broker might have charged for effecting the same transaction, in recognition of the value of the brokerage and research services provided by the broker to the Adviser or its sub-adviser.

For the Fund’s most recently completed fiscal period, the Fund did not pay any commissions on portfolio brokerage transactions to brokers who may be deemed to be affiliated persons of the Fund or the Adviser or affiliated persons of such persons.

Payment of Expenses. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement provide that the Adviser will bear its own costs of providing services under the agreement and is obligated to pay all expenses incurred by the Fund except for the fee paid to the Adviser pursuant to the Agreement, interest, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act (collectively, “Excluded Expenses”).

Other Provisions. Each of the Old Advisory Agreement, Interim Advisory Agreement and Proposed Advisory Agreement provide that the Adviser shall indemnify and hold harmless the Trust, its affiliated persons, and controlling persons against any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) by reason of or arising out of the Adviser’s willful misfeasance, bad faith or gross negligence generally in the performance of its duties, or by reason of the reckless disregard of its obligations and duties under the agreement. All other litigation arising out of the agreement, or any and every other nature, shall be satisfied solely out of the assets of the Fund, and the Adviser shall not be subject to liability to the Trust or the Fund or to any shareholder of the Fund for any act or omission in the course of, or connected with, rendering services under the agreement or for any losses that may be sustained in the purchase, holding or sale of any security by the Fund.

22

Executive Officers and Directors of the Adviser. Information regarding the principal executive officers and directors of the Adviser is set forth in Appendix A.

Other Funds with Similar Investment Objectives. Below is a list of other funds with similar investment objectives as the Fund managed by the Adviser, the size of each other fund and the rate of the Adviser’s compensation with respect to each other fund. The advisory fee is a unitary management fee based on each fund’s average daily net assets at the annual rate set forth in the table below. The fee is computed daily and paid monthly. The other funds’ investment objectives are similar to the FundsFund in that each fund’s investment objective is to seek to track, before fees and expenses, the performance of an underlying index, which is also listed below.

| Fund | Advisory Fee Rate | Assets of 12/31/14 | Underlying Index |

| Forensic Accounting ETF | 85 bps | $16,398,955 | Del Vecchio Earnings Quality Index1 |

Robo-StoxTM Global Robotics and Automation Index ETF | 95 bps | $104,570,189 | The Robo-STOX Global Robotics and Automation Index2 |

| Janus Equal Risk Weighted Large Cap ETF | 65 bps | $2,634,728 | Janus Equal Risk Weighted Large Cap Index3 |

| YieldShares High Income ETF | 50 bps | $80,393,531 | ISE High IncomeTM Index4 |

| EMQQ The Emerging Markets Internet & Ecommerce ETF | 86 bps | $4,531,185 | EMQQ The Emerging Markets Internet & Ecommerce IndexTM 5 |

| Yorkville High Income MLP ETF | 82 bps | $239,629,946 | Solactive High Income MLP Index6 |

| Yorkville High Income Infrastructure MLP ETF | 82 bps | $58,794,698 | Solactive High Income Infrastructure MLP Index7 |

23

| Fund | Advisory Fee Rate | Assets of 12/31/14 | Underlying Index |

| Source EURO STOXX 50 ETF | The greater of a minimum fee of $250,000, or 4 bps on the first $1.5 billion; 2 bps on the next $2.5 billion; and 1.5 bps on assets over $4 billion.9 | $38,404,955 | EURO STOXX 50 Net Return Index (USD)8 |

AlphaClone Alternative Alpha ETF | 95 bps | $88,872,433 | AlphaClone Hedge Fund Long/Short Index10 |

| Vident International Equity Fund | 75 bps | $696,516,034 | Vident International Equity Index11 |

| Vident Core U.S. Equity Fund | 55 bps | $297,573,181 | Vident Core U.S. Equity Index12 |

| Deep Value ETF | 80 bps | $214,550,445 | Tiedemann Wealth Management Deep Value Index13 |

| Falah Russell-IdealRatings U.S. Large Cap ETF | 70 bps | $1,288,873 | Russell-IdealRatings Islamic U.S. Large Cap Index14 |

| Vident Core U.S. Bond Strategy ETF | 45 bps | $367,471,656 | Vident Core U.S. Bond Strategy Index15 |

1. Comprised of 380-400 equity securities and designed to measure the performance of certain U.S. large capitalization companies that have been selected and ranked according to their “earnings quality.”

2. Comprised of U.S. and non-U.S. securities of robotics-related and/or automation related companies.

3. Comprised of all of the stocks in the S&P 500 Index, weighted according to a proprietary risk-weighting methodology.

4. Comprised of U.S. exchange-listed closed-end funds.

5. Comprised of publicly-traded, emerging market internet and ecommerce companies.

6. Comprised of master limited partnerships (“MLPs”) publicly-traded on a U.S. securities exchange.

7. Comprised of infrastructure MLPs publicly-traded on a U.S. securities exchange.

8. Comprised of equity securities designed to represent the performance of some of the largest companies across various sectors in Europe.

9. In addition, if the combined average daily net assets of all series in the Source ETF Trust is greater than $1 billion on September 16, 2016, the management fee from Source will be: 4 bps on the first $500 million; 3 bps on the next $1 billion; 2 bps on the next $2.5 billion; and 1.5 bps on assets over $4 billion.

10. Comprised of U.S. equity securities selected based on a proprietary hedge fund position replication methodology.

11. Comprised of emerging market securities selected by various governance screens.

24

12. Comprised of domestic equities selected by various governance screens.

13. Comprised of large capitalization securities selected based on various valuation metrics.

14. Comprised of the common stock of Shariah compliant large capitalization U.S. companies.

15. Comprised of fixed income securities selected by various governance screens.

Required Vote. Approval of Proposal 1B with respect to the Fund requires the affirmative vote of a “majority of the outstanding voting securities” of suchthe Fund when a quorum is present. Under the 1940 Act, a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the shares of the Fund present or represented by proxy at the Meeting if the holders of more than 50% of the outstanding shares are present or represented by proxy at the Meeting, or (b) more than 50% of the outstanding shares.

If Proposal 1B is approved by the Fund’s shareholders, the Proposed Advisory Agreement with respect to such Fund, is expected to become effective on the date of the Meeting. If Proposal 1B is not approved by the Fund’s shareholders, the Adviser will continue to serve as investment adviser to suchthe Fund pursuant to the Interim Advisory Agreement, and the Board will consider alternatives for the Fund, including seeking subsequent approval of a new investment advisory agreement by Fund shareholders.

Recommendation of the Board of Trustees. The Board believes that the terms and conditions of the Proposed Advisory Agreement are fair to, and in the best interests of, the Fund and its shareholders. The Board believes that, upon the Fund’s shareholder approval of Proposal 1B, the Adviser will continue providing the Fund the same level of services as it provided under the Old Advisory Agreement and currently provides under the Interim Advisory Agreement. The Board was presented with information demonstrating that the Proposed Advisory Agreement would enable Fund shareholders to continue to obtain quality services at a cost that is fair and reasonable.

In considering the Proposed Advisory Agreement, the Board took into consideration (i) the nature, extent and quality of the services to be provided by the Adviser; (ii) the historical performance of the Fund; (iii) the Adviser’s expected cost and profits realized from providing such services, including any fall-out benefits enjoyed by the Adviser or its affiliates; (iv) comparative fee and expense data for the Fund; (v) the extent to which the advisory fee for the Fund reflects economies of scale shared with Fund shareholders; and (vi) other factors the Board deemed to be relevant. In their deliberations, the Board did not identify any single piece of information discussed below that was all-important, controlling or determinative of its decision.

Nature, Extent and Quality of Services Provided. The Board considered the Adviser’s specific responsibilities in all aspects of day-to-day management of the Fund, such as providing portfolio investment management services. The Board noted that the services to be provided under the Proposed Advisory Agreement were identical in all material respects to those services provided under the Old Advisory Agreement and Interim Advisory Agreement. In particular, they noted that the Adviser has served as the Fund’s investment adviser since its inception.

In considering the nature, extent and quality of the services to be provided by the Adviser, the Board considered the quality of the Adviser’s compliance infrastructure The Board also considered the Adviser’s experience working with ETFs, including the Fund and series of the other Trusts managed by the Adviser. The Board noted that it had previously received a copy of the Adviser’s registration form (“Form ADV”), as well as the response of the Adviser to a detailed series of questions which included, among other things, information about the background and experience of the firm’s management and staff. The Board also considered the overall quality of the Adviser’s personnel, operations, financial condition, and investment advisory capabilities.

25

The Board considered other services provided to the Fund, such as overseeing the activities of the Fund’s investment sub-adviser and monitoring compliance with various Fund policies and procedures and with applicable securities regulations. Based on the factors above, as well as those discussed below, the Board concluded that it was satisfied with the nature, extent and quality of the services to be provided to the Fund by the Adviser.

Historical Performance. The Board then considered the past performance of the Fund. The Board noted that the index-based investment objective of the Fund made analysis of investment performance, in absolute terms, less of a priority than that which normally attaches to the performance of actively managed funds. Instead, the Board focused on the extent to which the Fund achieved its investment objective as a passively managed fund. In that regard, the Board reviewed information regarding factors impacting the performance of the Fund, including the construction of its underlying index and the addition or deletion of securities from the underlying index. The Board reviewed the information regarding the Fund’s index tracking, noting that the Fund satisfactorily tracked its underlying index.

Costs of Services Provided and Economies of Scale. The Board reviewed the advisory fees to be paid to the Adviser for its services to the Fund under the Proposed Advisory Agreement and compared the advisory fees to be paid by the Fund to those paid by comparable funds. The Board noted that the Fund’s advisory fees were consistent with the range of advisory fees paid by other peer funds.

The Board noted that the advisory fees payable under the Proposed Advisory Agreement were identical to the advisory fees paid under the Old Advisory Agreement. The Board took into consideration that the advisory fee for the Fund was a “unified fee,” meaning that the Fund would pay no expenses other than the Excluded Expenses. The Board noted that the Adviser would be responsible for compensating the Trust’s other service providers and paying the Fund’s other expenses out of its own fee and resources. The Board considered the costs and expenses incurred by the Adviser in providing advisory services, evaluated the compensation and benefits expected to be received by the Adviser from its relationship with the Fund, and performed a profitability analysis with respect to the Fund. The Board concluded that the advisory fees appeared reasonable in light of the services rendered. In addition, the Board considered for the Fund whether economies of scale have been realized. The Board concluded that no significant economies of scale have been realized by the Fund and that the Board will have the opportunity to periodically reexamine whether such economies have been achieved.

26

Conclusion. No single factor was determinative of the Board’s decision to approve the Proposed Advisory Agreement on behalf of the Fund; rather, the Board based its determination on the total mix of information available to it. Based on a consideration of all the factors in their totality, the Board, including a majority of the Independent Trustees, determined that the Proposed Advisory Agreement, including the compensation payable under the agreement, was fair and reasonable to the Fund. The Board, including a majority of the Independent Trustees, therefore determined that the approval of the Proposed Advisory Agreement was in the best interests of the Fund and its shareholders.

The Board of Trustees of Exchange Traded Concepts Trust II unanimously recommends that

shareholders of the Fund vote “FOR” Proposal 1B.

27

PROPOSAL 2

Approval of New Sub-Advisory Agreements

Approval of New Sub-Advisory Agreements

Background

As described above under “Proposal 1—Background,” the Transaction resulted in the termination of the Old Advisory Agreements between each Trust and the Adviser. The Transaction also resulted in the termination of the sub-advisory agreement between the Adviser and Yorkville ETF Advisors, LLC, on behalf of the Yorkville High Income MLP ETF and the Yorkville High Income Infrastructure MLP ETF (the “Yorkville Sub-Advisory Agreement”). Further, the termination of the Old Advisory Agreements caused the automatic termination of all of the Adviser’s other sub-advisory agreements (together with the Yorkville Sub-Advisory Agreement, each an “Old Sub-Advisory Agreement”). Accordingly, in Proposals 2A, 2B, 2C, and 2D (collectively, “Proposal 2”), the Boards are requesting that shareholders approve new sub-advisory agreements (each, a “Proposed Sub-Advisory Agreement”) with the sub-advisers (each, a “Sub-Adviser”) listed under the fourth column in the following tables:

Exchange Traded Concepts Trust

| Fund | Sub-Adviser(s) under Old Sub-Advisory Agreement | Sub-Adviser(s) under Interim Sub-Advisory Agreement | Sub-Adviser(s) under Proposed Sub-Advisory Agreement |

| Forensic Accounting ETF | Index Management Solutions LLC | Penserra Capital Management LLC | Vident Investment Advisory LLC |

ROBO-STOXTM Global Robotics and Automation Index ETF | Index Management Solutions LLC | Penserra Capital Management LLC | Vident Investment Advisory LLC |

| Janus Equal Risk Weighted Large Cap ETF | Index Management Solutions LLC | Penserra Capital Management LLC | Vident Investment Advisory LLC |

| YieldShares High Income ETF | Index Management Solutions LLC | Penserra Capital Management LLC | Vident Investment Advisory LLC |

| EMQQ The Emerging Markets Internet & Ecommerce ETF | Penserra Capital Management LLC | Penserra Capital Management LLC | Penserra Capital Management LLC |

| Yorkville High Income MLP ETF | Yorkville ETF Advisors, LLC Index Management Solutions LLC | Yorkville ETF Advisors, LLC Penserra Capital Management LLC | Yorkville ETF Advisors, LLC Penserra Capital Management LLC |

| Yorkville High Income Infrastructure MLP ETF | Yorkville ETF Advisors, LLC Index Management Solutions LLC | Yorkville ETF Advisors, LLC Penserra Capital Management LLC | Yorkville ETF Advisors, LLC Penserra Capital Management LLC |

28

Exchange Traded Concepts Trust II

| Fund | Sub-Adviser under Old Sub-Advisory Agreement | Sub-Adviser under Interim Sub-Advisory Agreement | Sub-Adviser under Proposed Sub-Advisory Agreement |

| Horizons S&P 500® Covered Call ETF | Horizons ETFs Management (USA) LLC | Horizons ETFs Management (USA) LLC | Horizons ETFs Management (USA) LLC |

In anticipation of the Transaction, at a special in-person meeting on December 19, 2014, the Boards, including a majority of the Independent Trustees, approved interim sub-advisory agreements between the Adviser and the Sub-Advisers listed in the third column of the table above (each, an “Interim Sub-Advisory Agreement”). As permitted by the 1940 Act, certain of the Sub-Advisers under the Old Sub-Advisory Agreements, including Yorkville ETF Advisors, LLC (“Yorkville Advisors”), Penserra Capital Management LLC (“Penserra”), and Horizons ETFs Management (USA) LLC (“Horizons”) continued serving as sub-advisers to their respective Funds upon the effectiveness of the Transaction pursuant to Interim Sub-Advisory Agreements. However, with respect to Yorkville High Income MLP ETF and Yorkville High Income Infrastructure MLP ETF (the “Yorkville Funds”), Forensic Accounting ETF, ROBO-STOXTM Global Robotics and Automation Index ETF, and Janus Equal Risk Weighted Large Cap ETF, each of which was sub-advised by Index Management Solutions LLC (“IMS”), the Board approved Interim Sub-Advisory Agreements with Penserra, at the recommendation of the Adviser, to replace the Old Sub-Advisory Agreements between the Adviser and IMS.

All Funds, except the Yorkville Funds. The Interim Sub-Advisory Agreements have the same sub-advisory fee rates as the Old Sub-Advisory Agreements. For all Funds, except the Yorkville Funds, the Interim Sub-Advisory Agreements are also the same in all other material respects as the Old Sub-Advisory Agreements, except that the Funds formerly sub-advised by IMS are being sub-advised by Penserra and, as required by the 1940 Act, the Interim Sub-Advisory Agreements have a term of up to 150 days.

Yorkville Funds. The Interim Sub-Advisory Agreements have the same sub-advisory fee rates as the Old Sub-Advisory Agreements. The Yorkville Funds, however, have two sets of Interim Sub-Advisory Agreements.Agreements, one with Yorkville Advisors and the other with Penserra. Yorkville Advisors is the investment sub-adviser to the Yorkville Funds and is responsible for the day-to-day management of the Yorkville Funds. Yorkville Advisors also makes investment decisions for the Yorkville Funds and continuously reviews, supervises and administers the investment program of the Yorkville Funds, subject to the supervision of the Adviser and the Board. Penserra is the trading sub-adviser to the Yorkville Funds and is responsible for trading portfolio securities on behalf of the Yorkville Funds, including selecting broker-dealers to execute purchase and sale transactions as instructed by Yorkville Advisors or in connection with any rebalancing or reconstitution of the Yorkville Funds’ underlying indexes, subject to the supervision of the Adviser and the Board of Trustees. The Interim Sub-Advisory Agreement between the Adviser and Yorkville Advisors is the same in all material respects as the Old Sub-Advisory Agreement, except that, as required by the 1940 Act, the Interim Sub-Advisory Agreement has a term of up to 150 days and requires that compensation payable to Yorkville Advisors be kept in an escrow account pending shareholder approval of the Proposed Sub-Advisory Agreement. If the Proposed Sub-Advisory Agreement between the Adviser and Yorkville Advisors is not approved by Fund shareholders, Yorkville Advisors, under the Interim Sub-Advisory Agreement, will be entitled to be paid the lesser of any costs incurred in performing the interim contract and the total amount in the escrow account. The Interim Sub-Advisory Agreement with Yorkville Advisors is subject to the same escrow account requirement as the Interim Advisory Agreements because Yorkville Advisors theAdvisors’ Old Sub-Advisory Agreement terminated as a result of the Transaction. Further, the Interim Sub-Advisory Agreement between the Adviser and Penserra, also with respect to the Yorkville Funds, is the same in all material respects as the Old Sub-Advisory Agreement between the Adviser and IMS, except that Penserra replaced IMS and, as required by the 1940 Act, the Interim Sub-Advisory Agreement has a term of up to 150 days.

29

The Proposed Sub-Advisory Agreements require shareholder approval in order to enable the Funds to continue to be managed in a manner that is substantially similar to the management of the Funds prior to the Transaction. At a meeting on January 22, 2015, the Boards, including a majority of the Independent Trustees, approved the Proposed Sub-Advisory Agreements and recommended that they be submitted to Fund shareholders for approval.

The Proposed Sub-Advisory Agreements are substantially similar to the Old Sub-Advisory Agreements that were in place for the Funds. With respect to the Funds previously sub-advised by IMS, however, the Board of Trustees of Exchange Traded Concepts Trust has determined to replace IMS as sub-adviser. Accordingly, the Proposed Sub-Advisory Agreements for those Funds involve new entities as sub-advisers, either Vident Investment Advisory, LLC or Penserra Capital Management LLC, and new fee arrangements with those sub-advisers. The proposed new fee arrangements will not change the overall investment advisory fees paid by the Funds. The terms of the Proposed Sub-Advisory Agreements are otherwise substantially similar to the corresponding Old Sub-Advisory Agreements with IMS.

30

Information Relating to Proposal 2A

Vident Investment Advisory LLC

Proposed Sub-Advisory Agreement

Forensic Accounting ETF

ROBO-STOXTM Global Robotics and Automation Index ETF

Janus Equal Risk Weighted Large Cap ETF

YieldShares High Income ETF

In Proposal 2A, the Board of Trustees of the Exchange Traded Concepts Trust (the “Trust”) requests that shareholders approve a Proposed Sub-Advisory Agreement between the Adviser and Vident Investment Advisory LLC (“Vident”) with respect to the Forensic Accounting ETF, ROBO-STOXTM Global Robotics and Automation Index ETF, Janus Equal Risk Weighted Large Cap ETF (formerly, VelocityShares Equal Risk Weighted Large Cap ETF) and YieldShares High Income ETF (collectively, the “Vident Funds”“Funds”).

Prior to the Transaction, the Vident Funds were sub-advised by IMS pursuant to the Old Sub-Advisory Agreement dated March 2, 2012, as amended, which was approved by each Fund’s initial shareholder on the dates shown below, and was not subsequently submitted to a vote of Fund shareholders. The Old Sub-Advisory Agreement was renewed by the Trust’s Board of Trustees (the “Board”) on February 18, 2014.

| Fund | Shareholder Approval Date |

| Forensic Accounting ETF | January 30, 2013 |

ROBO-STOXTM Global Robotics and Automation Index ETF | October 16, 2013 |

| Janus Equal Risk Weighted Large Cap ETF | July 28, 2013 |

| YieldShares High Income ETF | June 11, 2012 |

However, upon the recommendation of the Adviser and having conducted due diligence regarding Vident, the Board has determined that the approval of Vident as the sub-adviser to the Vident Funds is in the best interests of the Vident Funds and their shareholders. The approval of Vident stems from a change in personnel at IMS. On or about November 11, 2014, Denise M. Krisko, previously the Chief Investment Officer of IMS, left IMS to join Vident as its President. Prior to leaving IMS, Ms. Krisko had been each Fund’s portfolio manager since its inception.